Once they’ve set up their Cash App (or Venmo, or PayPal) account and linked their bank account, they’ll receive the payment. They’ll receive a notification via text (if you used their phone number) or via email (if you sent the payment to their email), prompting them to – you guessed it – set up an account with the payment service. But what happens if the person you just sent money to through Cash App doesn’t have a Cash App account set up? Many of these payment services will allow you to send a payment to someone using just their cell phone number and/or email address. What if I send a payment to someone who doesn’t have the same payment app as I do? Contact the intended recipient directly, or go directly to the app or financial institution website to confirm any possible problem.Don’t provide personal or financial info over the phone, web or email.If you think there may be a problem with your account or a payment you made, go to the website or app and access your account directly. This address is meant to look legit but it’s NOT PayPal. Email addresses can be spoofed, but usually you can see a fake email has come from something like “ (for example). For simplicity and fee-free payment transfers, you’ll likely need to link your bank account.Īs with any email or phone call from someone claiming to need personal data from you:

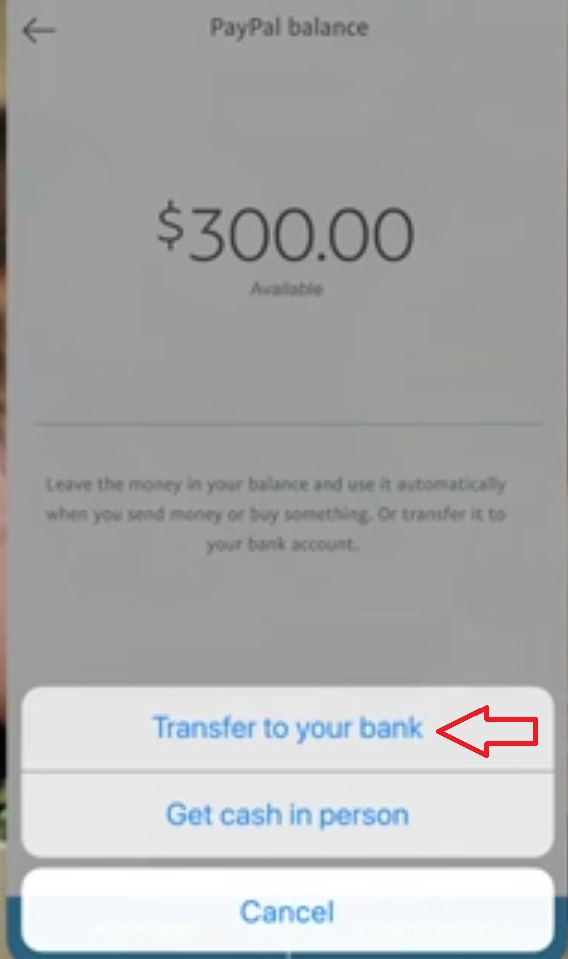

Each of these services lets you make payments from a linked credit card or some have their own credit cards with varying fees. When making a payment: there’s no fee to you if you send money from a linked bank account. Once your bank account is linked, tap on the Add money option. Follow the on-screen instructions to link your bank account to PayPal. On the home screen, locate and tap on the Wallet tab. If you toggle this on, taxes a percentage of your payment will be withheld by Venmo as a merchant processing fee, so it’s important that you don’t accidentally toggle this on if you’re splitting dinner or reimbursing someone. Follow these steps to complete the process: Log in to your PayPal account using the PayPal mobile app or website. Tip #4: When you are making the payment, Venmo will now ask you if you are paying for a product or service and prompt you to toggle a button to green/yes if you are. Will there be a differentiation of payments received from personal or business use? It is already obscure for even cash apps to discern when transaction memos are sometimes emojis.Tip #3: Typically when you are paying someone for the first time Venmo at least will prompt you to enter their cell phone number (the number of the phone they have the app installed on) so that you can be more sure you’re sending money to the right person, but you don’t HAVE to supply one. "Is it worth it to go after these players, or these consumers, who are generally transferring a few hundred dollars on a monthly basis, so I'm just thinking about the cost-benefit here," Johan said. Johan said the IRS is trying to bridge a tax gap of billions of dollars from lack of taxpayer compliance in reporting. "From $20,000 to $600 - I'm just trying to figure out what kind of consumers they are trying to sort of catch," said Sofia Johan, an associate professor of finance at Florida Atlantic University. The IRS won't be cracking down on personal transactions, but a new law will require cash apps like Venmo, Zelle and Paypal to report aggregate business transactions of $600 or more to the IRS. "I actually pay rent through it for my apartment, so that's over $600," Murphy said. Margarita Murphy uses Zelle regularly, including for big expenses. In a mostly cash-less world, it's easy to use apps to make everyday payments. WPTV Margarita Murphy says she uses cash app transactions to pay her rent.

0 kommentar(er)

0 kommentar(er)